The Four-Stage Programme.

Elevate Your Trading Skills from Foundation to Advanced Independence

Once you have successfully completed the Foundation Programme, our four-stage programme equips you with the essential tools and knowledge to evolve into an advanced and independent trader.

Stage 1

The Dirt Collecting Stage

In Stage 1 of our programme, known as the Dirt Collecting Stage, the primary objective is to acquaint yourself with the concepts and fundamentals of trading. This stage emphasises quantity over quality, encouraging you to take replay trades to gain familiarity and experience.

Topics Covered:

Foundations

- Introduction to your mentor

- Understanding the traits of a successful trader

- Unveiling organic successes and trading formulas

- Exploring psychological market behavior

- Shaping your trader's profile

Fundamentals

- Currency pairs and their dynamics

- Analysing market fundamentals and news

- Identifying and capitalising on trading regulation reversals

Trading Regulation Reversals

- Part 1/2/3/4/5 (each part has different time frames and sessions)

Highs and Lows

- In-depth exploration of highs and lows in trading

- Comprehensive breakdown across multiple time frames and sessions

Chart psychology

- Deep dive into chart psychology and its impact on trading decisions

- Detailed analysis across multiple time frames and sessions

Assessment and Implementation

- Evaluating your progress and comprehension of Stage 1 concepts

-

Implementing the acquired knowledge into your trading strategies

Stage 2

Unleashing the Power of Risk and Reward

In Stage 2 of our programme, you will delve into the potent realm of risk and reward. Building upon the foundational 1:1 concepts, this stage empowers you to combine them effectively, unlocking setups with ratios ranging from 1:2 to an impressive 1:10.

Topics Covered:

Combination Trades

- Exploring the intricacies of combining different trade setups

- Mastering intraday and swing trades across multiple parts and sessions

Focus on Risk-to-Reward:

- Understanding the significance of risk-to-reward ratios in trading

- Learning techniques to optimise risk management for enhanced profitability

Assessment:

- Evaluating your progress and understanding of Stage 2 concepts

Average Calculations:

- Calculating averages and understanding their relevance in trading analysis

- In-depth exploration across multiple parts and sessions

Logging and Journaling:

- Emphasising the importance of maintaining a trading log and journal

- Comprehensive guidance across multiple parts and sessions

Chart Psychology:

- Advancing your knowledge of chart psychology and its impact on trading decisions

- Detailed analysis across multiple parts and sessions

Assessment and Implementation:

- Assessing your proficiency in Stage 2 concepts

- Integrating the acquired knowledge into your trading strategies

Stage 3

Implementation Mastery

In Stage 3 of our program, armed with a solid understanding of fundamentals and concepts, it's time to put your knowledge into action. This stage focuses on implementation, specifically guiding you on trading cross pairs after primarily focusing on majors in Stages 1 and 2. To complete Stage 3, you will be challenged to achieve three weeks with an overall gain of 500 pips or 40Rs overall for Month 1 and 20Rs overall for Month 2 to simulate trading against a prop firm challenge in real life.

Topics Covered:

Cross Pairs:

- In-depth exploration of trading cross pairs

- Comprehensive coverage across multiple parts

Active and Inactive Majors Combined:

- Understanding the dynamics of trading active and inactive major currency pairs together

- Detailed analysis across multiple parts

Active and Active Majors Combined:

- Exploring the intricacies of trading combinations of active major currency pairs

- Comprehensive guidance across multiple parts

Simulations:

- Engaging in 2D and 3D simulations to enhance trading skills

- Analysing the best trades of the week

- Recognising traps and manipulations in the market

- Establishing backup trades for risk management purposes

Forecasting Losses and Wins:

- Mastering the art of forecasting potential losses and wins

- Implementing effective risk management strategies

- Creation and implementation of risk management plans across multiple parts

Stacking Trades:

- Maximising trading opportunities by stacking multiple take profit levels

- Exploring higher timeframe trades for increased potential

- Assessing and implementing strategies for stacking trades

Assessment and Implementation:

- Evaluating your proficiency in Stage 3 concepts

- Applying the acquired knowledge and strategies to your trading approach

Stage 4

Solidifying Your Trading Plan

In Stage 4 of our program, you will refine and solidify your trading plan to achieve consistent success. With your trading strategy perfected, the focus now shifts to effective risk management and goal setting. The objective is to utilise minimal percentages of 0.25% to 1% on trades, targeting an overall weekly goal of 10% on your demo account.

Topics Covered:

Trading Plan:

- Comprehensive guidance on creating a well-defined trading plan

- Exploring various components across multiple parts

Planning for the Week Ahead:

- Strategies and techniques for planning trades and anticipating market movements

- Detailed analysis and preparation across multiple parts

Eye on the Percentage:

- Understanding the significance of maintaining strict risk percentages per trade

- Managing and controlling risk exposure effectively across multiple parts

Maintaining Consistency:

- Establishing habits and routines to maintain consistent trading performance

- Techniques to overcome emotional and psychological challenges across multiple parts

Setting Quarterly and Yearly Targets:

- Developing achievable targets for both short-term and long-term trading goals

- Strategies for tracking progress and adapting goals as needed across multiple parts

Passing FTMO/MFF:

- Revealing the secrets to successfully passing the FTMO challenge and getting funded

- Insights into how other students have achieved success

Assessment and Implementation:

- Evaluating your understanding and proficiency in Stage 4 concepts

- Implementing the acquired knowledge and strategies into your trading plan

Common Questions about the 4-Stage Programme

If you have any further questions that are not addressed here, please feel free to email them to [email protected]. Our team will be happy to assist you.

What if I fail a stage?

Will I get access to all four stages at once?

How long will it take for me to complete the entire course?

How much does it cost?

Is the course only online or inperson?

How do I sign up?

- Time Zones: All UK times are in GMT. All US times are in EST/CST/MST/PST (standard time).

- Australia: Melbourne times shown are in AEDT (Australian Eastern Daylight Time).

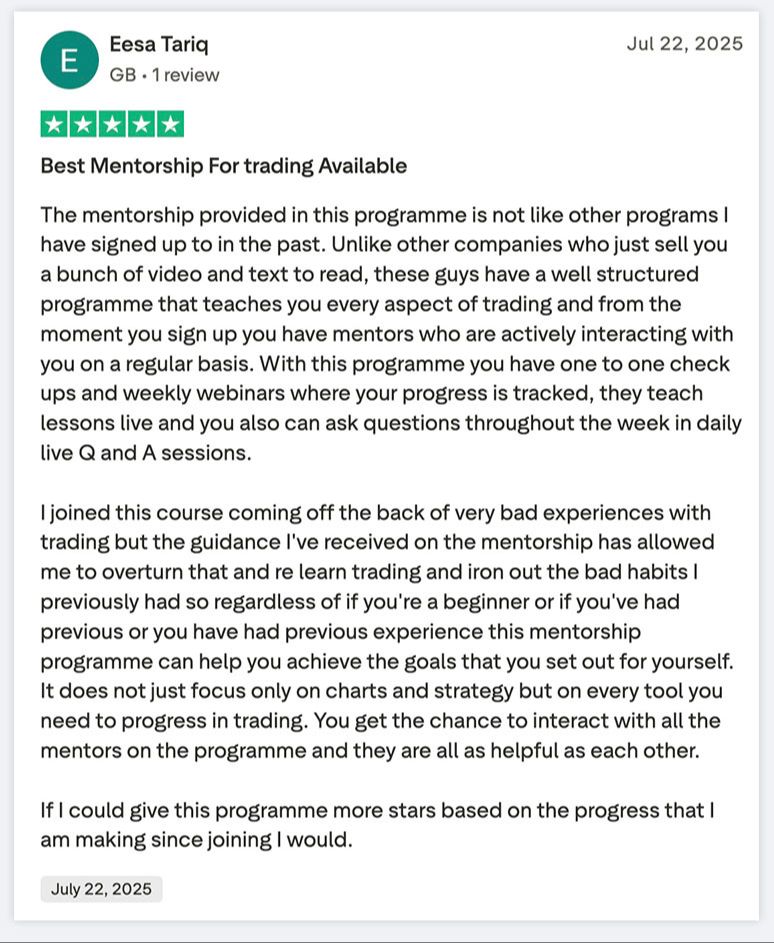

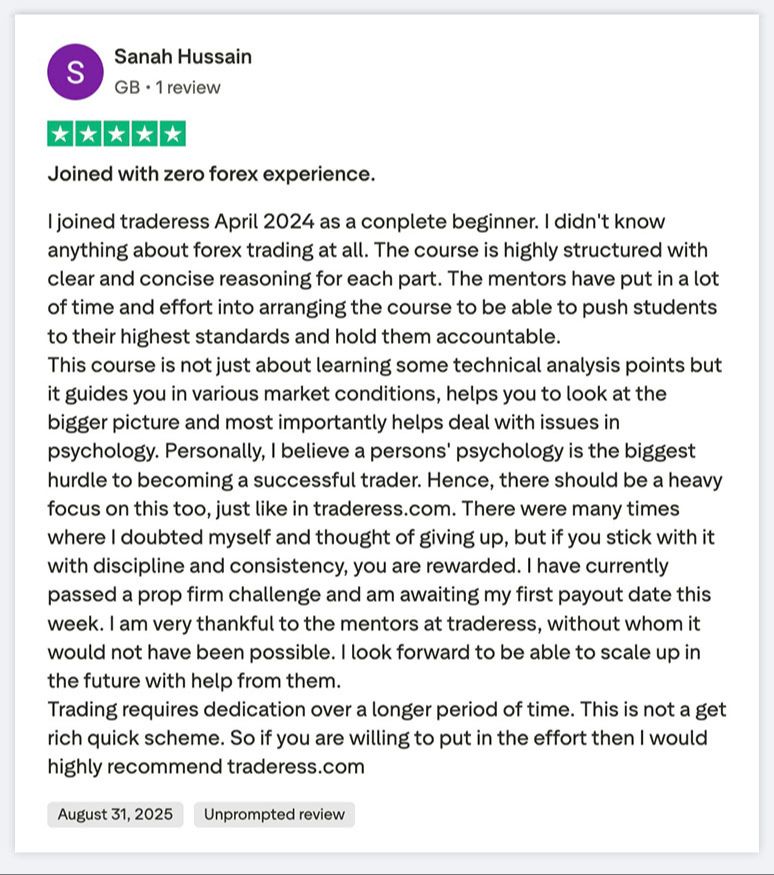

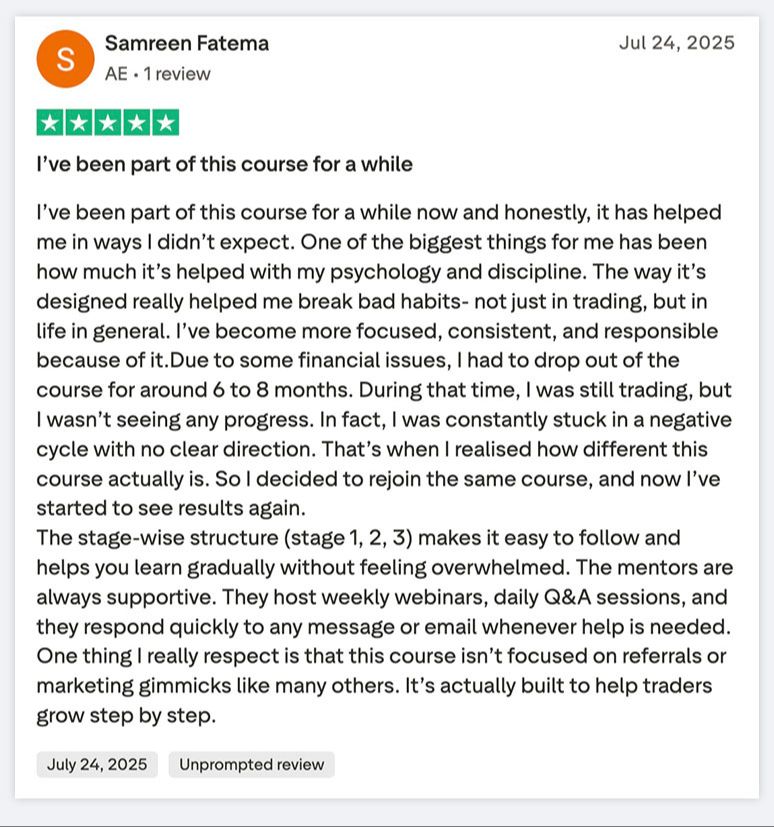

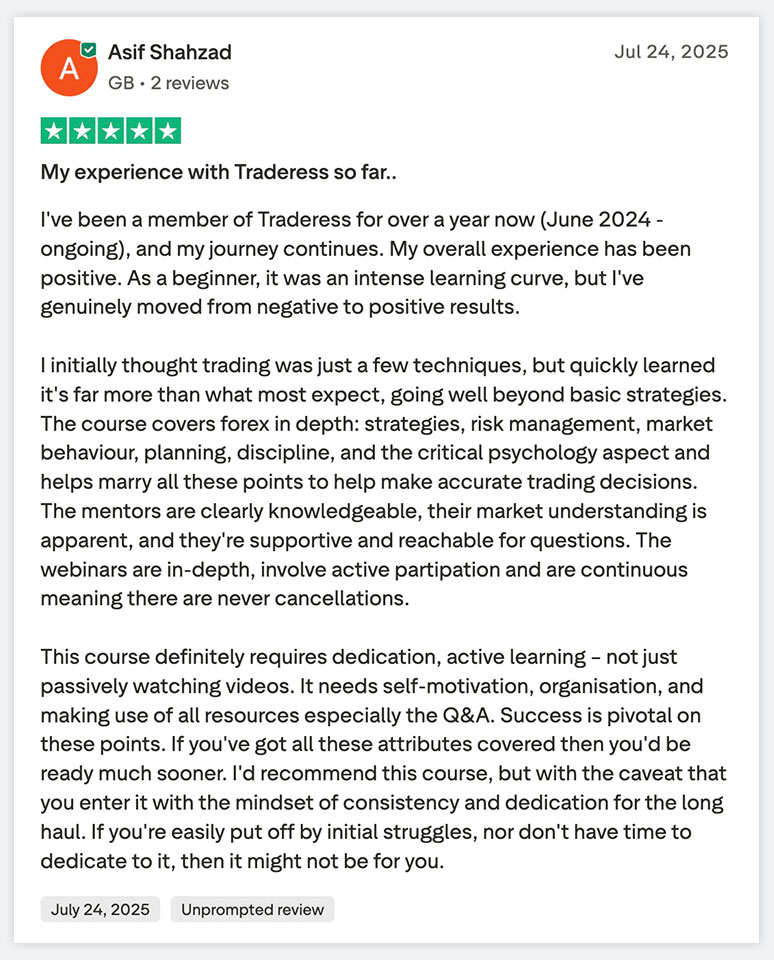

What our students have to say...